18 July 2019

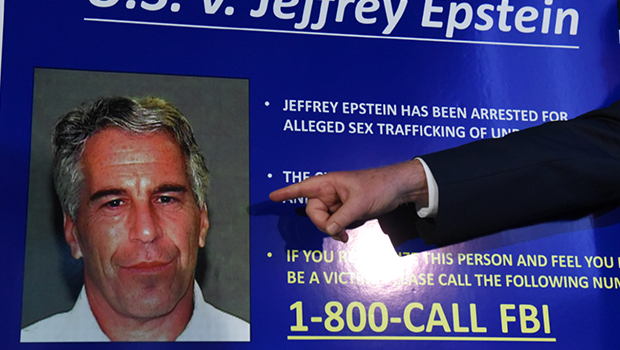

Fresh revelations from ICIJ investigations, raise the likelihood that sex offender Jeffrey Epstein cloaked his fortune in a series of offshore shell companies registered in notoriously secretive tax havens.

The most extensive document — amounting to 500 pages detailing the activities of an Epstein offshore vehicle — comes from the Paradise Papers trove, millions of files leaked from the Bermuda-founded offshore services provider Appleby.

The files reportedly show that, by the mid-2000s Epstein’s firm had joined a roster of the world’s wealthiest people and corporations in working with Appleby, and therefore gaining a skilled group of experts to help it navigate the secretive and low-tax world of offshore finance, the new report states.

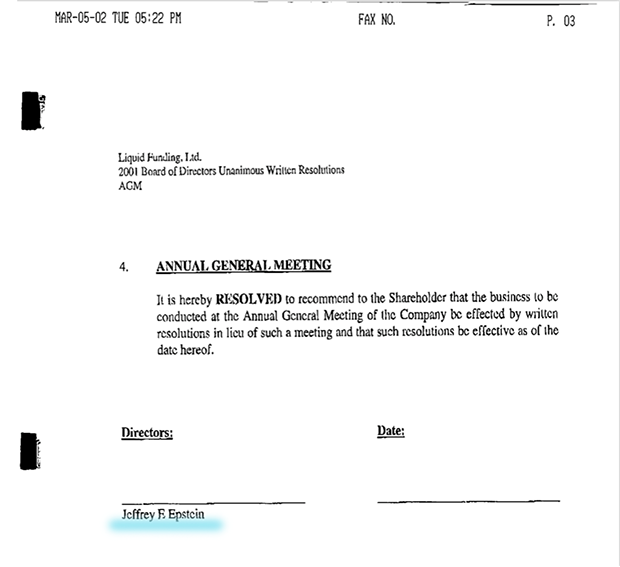

From at least 2000 to 2007, Epstein chaired a company registered in Bermuda called Liquid Funding Ltd. This entity was partially owned by the investment bank Bear Stearns, where Epstein had worked, according to the report. The bank’s collapse would help set in motion the 2008 financial crisis.

Epstein’s offshore company was loaded up with some of the financial products — like mortgage-backed securities and collateralized loan obligations — that would become synonymous with the financial excesses leading to the financial crisis.

According to the Miami Herald and McClatchy, Liquid Funding had commercial mortgages and investment-grade residential mortgages bundled into complex securities.

“The three main credit rating agencies — Standard & Poor’s, Fitch Ratings and Moody’s Investors Service — all helped Bear Stearns create the securities in a way that would allow the creative product to get a gold-plated AAA rating,” the Miami Herald and McClatchy reported.

Jeffrey Epstein’s offshore fortune traced to Paradise Papers